CBC asks if the housing bubble will pop as a result of tightened capital controls? Will China’s tightened capital controls pop the housing bubble? China imposes further restrictions to control capital flowing out of the country This month, the limit on foreign currency transactions in China was lowered to $9,000 to increase scrutiny on investment money flowing out […]

Bubbleology – The new religion of 2/3 Canadians who believe Housing Bubble is Real

Apparently as many as 2/3 Canadians have converted to a new religion known as “Bubbleology”. To the faithful Bubbleologists, Housing Bubble is the mighty Devil and his coming is imminent. Because certain unscrupulous profiteers have provoked the wrath of the Lord. However, Housing Bubble is no Armageddon, it’s not the end of the world yet. It’s just that there […]

Canada Tops Indebtedness, Vancouver’s Costliest Listing, Cooling Measures Backfires, Bubble Coming Back

Real Estate Roundup Global News reported Canada is a celebrity when it come to debts, not only houldhold debts, but also commercial debts that is heavily skewed toward real estate. While the real estate is entering a tumultous era, Vancouver shows off her most expensive listing ever – $63 millions Belmont Estate, a 21,977 sf home […]

Chinese Insatiable Appetite For Canadian Real Estate Continues

The Chinese have been #1 investors for Canadian real estate … Nothing new. Instead of slowing down after the infamous Vancouver Foreign Buyer Tax, they come in greater number as if apocalypse is going to land in the Middle Kingdom soon. The momentum continues, home prices keep going north, millenials remain in the same doldrum as […]

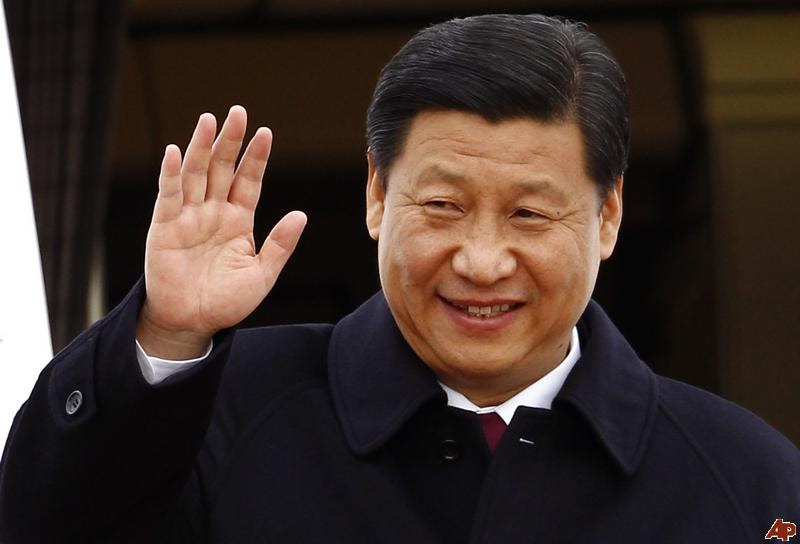

Nouveau Silk Road: From Middle Kingdom to The Great White North

Jonathan Manthorpe believes there is a direct line linking the explosive real estate bubbles in Toronto and Vancouver and how secure Chinese President Xi Jinping looks on his throne. How China’s Politics Messing Up Canadian Real Estate Markets The evidence — the vast amount of money being spirited out of China by relatives, friends and cronies of […]

The Great Canadian Real Estate Continues To Fly Sky High

House prices are coming down like “London Bridge is falling down”? Dream on … Housing Bubble or not, all indications suggest no one believes Chicken Little: “The sky is falling!” … Canadian Real Estate Could Still Get Way More Expensive Huffington Post Canada – Jul 16, 2016 Global comparison puts Canadian home affordability in perspective. Image […]