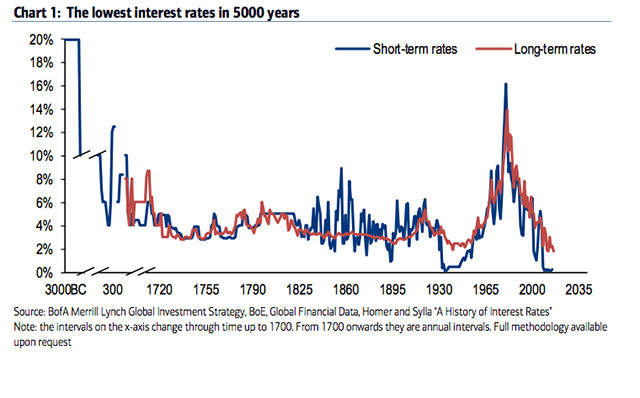

I have always expected this will be the direction Canada is heading – The government will keep interest low and keep printing money. Image Source Is there a problem here?

Canadian interest rates are the lowest in 5,000 years

While folk are debating solutions for our problems, blaming foreign money and our immigration programs as the main culprits such as this article – Toronto, don’t let Vancouver’s housing crisis become yours. Whereby Josh Gordon, an assistant professor at the Simon Fraser University School of Public Policy writes about (and invited a lot of heated arguments): – Concern about foreign […]

The Great Canadian Real Estate Continues To Fly Sky High

House prices are coming down like “London Bridge is falling down”? Dream on … Housing Bubble or not, all indications suggest no one believes Chicken Little: “The sky is falling!” … Canadian Real Estate Could Still Get Way More Expensive Huffington Post Canada – Jul 16, 2016 Global comparison puts Canadian home affordability in perspective. Image […]

Brexit Effects On Canadian Mortgage And Real Estate

Let’s examine what to expect as a result of Brexit … Could it be a “Real EstatExit” in the making for the Great White North? How the Brexit Affects Canadian Mortgage Rates Image Source

Mortgage Tightening, Loophole, and Housing Crash?

The headings below say it all. But fret not … No housing woes in Canada, mortgage lobby says, but many beg to differ Image Source

Canada Real Estate Is Still Very Rosy

Canadians richer than ever, and cutting back on mortgage debt Debt growth eases Canadians are getting the message on their ugly debt levels, at the same time as their wealth increases. Mortgage debt growth slowed: Statistics Canada Mortgage debt in Canada rose just 0.6 per cent in the first quarter of the year, to $1.1-trillion, […]