We didn’t say that.

This what Khaleej Times say. And this also echoed by Seeking Alpha.

Some folks tend to believe the local media are inclined to parrot what the local business/government wanted you to hear. It’s for this reason, opinion by foreigne experts are somewhat influential because it is assumed experts from abroad may see what the locals couldn’t see. It’s also usually assumed foreign experts typically have no vested interest in Canada’s real estate, their opinion is therefore “impartial”.

Regardless, our advise is take everything with a pinch of salt. For exmaple, if the media tells you the inflation rate is 1%, you should assume the actual figure could be as high as 10%, or if they tell you condo prices in Canada is still at a steal price because it’s still cheaper than those in Manhattan, you shouldn’t look at the price but compare other factors to see if Canada is even Manhattan to begin with?

You know, this world is full of “Voodooism” … “Now you see, now you don’t” kind of phenemenon.

Here is what the “foreign experts” say,

Guess what? The Canadian home price bubble has just bursted

Khaleej Times

As some have learnt the hard way, leverage wipes out investor equity when a housing bubble bursts

The Canadian housing bubble has gone so ballistic that the Ontario government is considering a 15 per cent tax on foreign buyers to cool down the speculative spiral in Toronto condominiums. The smart money on Wall Street’ latest trade is to short Canadian banks and property developers, the fabled hedge fund Great White Short. Canadian property prices have doubled in the past decade, thanks to low interest rates, high-end immigration, flight capital from China/Southeast Asia, with Toronto and Vancouver the epicentre of the housing bubble.

A housing bubble is a money-spinning feast for speculators since they only put down 10-25 per cent as an initial downpayment. Yet as some learnt the hard way, leverage wipes out investor equity when a housing bubble bursts, often taking down entire banking systems and consumer economies. In countries that criminalise bankruptcy, the choice for a leveraged homeowner when a bubble bursts is to either face jail or flee. This is not the case in the US the Canada, where non-recourse mortgages make home price speculation a one-way bet when prices soar in a speculative bubble.

Canadian home prices have gone parabolic since 2010, up 60 per cent despite the plunge in crude oil prices and the election of a Liberal Party Prime Minister in Ottawa. Yet there are now unmistakable signs that the Canadian housing bubble is about to pop. New home sales have plunged even though prices are at record highs. The governor of the Bank of Canada and the CEO of Royal Bank of Canada have warned investors about the lethal risks of leveraged home price speculation. Affordability ratios are in the stratosphere. Canadian household debt to disposable income is at all-time highs, at a staggering 169 per cent. Flippers boast about their offplan “profits” at cocktail parties. I have GCC-based friends who refuse to rent out their Toronto condos because they believe 20 per cent price rises will continue forever and friends in Canada whose suburban McMansions consume 40 per cent of their annual income in mortgage, taxes and insurance costs. Ottawa and the provincial governments in Canada are now determined to burst the speculative credit Frankenstein that caused the boom. Ontario’s Fair Housing Plan only tells me this time the wolf is here. The near collapse of subprime mortgage lender. Home Capital Group has eerie echoes of the failure of Lehman Brothers. Home Capital shares fell 90 per cent before Warren Buffet financed C$2.4 billion lifeboat.

A decade ago, Canadian housing was a relative safe haven in the 2008 financial crisis. Home prices in Canada fell a mere seven per cent, compared to 30 per cent in the US and 50-70 per cent in high-beta markets like Spain’s Costa del Sol (or Britain’s Costa del Dole!). Canadian home prices have risen 60 per cent since the crisis, which left its Big Six banks unscathed. This is a far better performance than even the hottest markets in the US, which have risen only 25 per cent since their bottom and took six years to recover their crisis losses.

Unlike the property markets of the GCC, Canadian home prices have structural safety nets. No less than 50 per cent of home mortgages are insured by state agencies. The big six Canadian banks are some of the world’s most transparent and best governed financial institutions. All immigrants are granted citizenship. There is no geopolitical risk and the banking system is not in the grip of a credit crunch or forced mergers. Oil is only 25 per cent of Canadian GDP and the entire population is not on the state payroll, apart from Alberta. However, Toronto witnessed a 40 per cent price crash in the early 1990s that wiped out several friends of mine who speculated on new-build condos. When supply overwhelms demand, when new sales values plunge, when cranes dot the skyline and offplan launches scream out in newspaper ads, a crash is imminent. The coming interest rate rise will be property’s kiss of death. There are rumours of systemic fraud and more mortgage lender failures even as I write. Yes, this time the wolf is here.

Unlike growth companies on a stock market, a housing bubble is destined to collapse since homes lose value over time due to depreciation and shifts in consumer preferences. Home price spirals destroy, not create, economic value and can often gut the stability of banking systems via default and retail sales due to negative wealth effects on consumer spending. As Santayana said, “those who refuse to learn the lessons of history are doomed to repeat them” – specially when debt is the high-octane fuel that burns homeowners alive … Khaleej Times

The writer is a global equities strategist and fund manager. He can be contacted at [email protected].

The Incheon Tri-bowl Cultural Center, South Korea (Source)

The Incheon Tri-bowl Cultural Center, South Korea (Source)

Significant Toronto Real Estate Price Drop in June

Steer Clear: Canada’s Real Estate Bubble May Burst

Summary

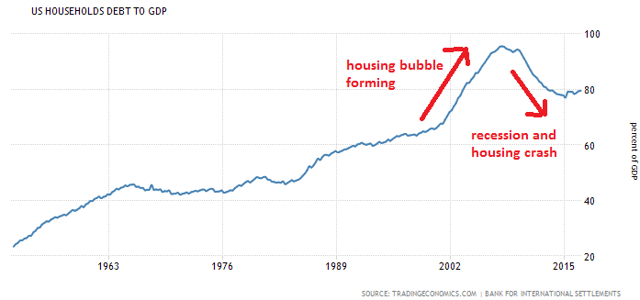

Canada’s household debt to GDP ratio now exceeds the US’s at the height of its housing bubble.

Berkshire’s bailout of Home Capital Group may be the canary in the coalmine.

Risk is high as Canadian stock indexes are heavily overweight financials.

Since the financial crisis, we’ve stayed away from investing in Canada due to the country’s high level of household debt. Right now, we believe that it’s even more important for investors to avoid Canada as recent weakness in a Canadian mortgage lender may signal that the household debt bubble primarily concentrated in real estate may be ready to burst.

The reason why household debt is such an important thing to look at has to do with how consumers drive economies. In the US consumers account for almost 70% of GDP. While the figure for Canada is not as high – consumer spending up north is only about 56% of GDP – it’s still the largest part of the Canadian economy. When consumers began building new homes and taking out second mortgages and home equity lines of credit and using that extra money to buy goods and services, it drives economic growth. However, when consumers take on debt it must be paid back eventually. When the housing bubble collapsed in the US, so too did the underpinning of what was driving consumption spending. Because it accounted for such a large percentage of the economy, we had the worst recession since the Great Depression.

We can see eerie similarities between Canada today and the US prior to the great recession. To start with, let’s look at what the US real estate bubble looked like. The chart below shows household debt to GDP for the US. You can see how household debt increases during the almost decade-long housing bubble, and then it falls once the housing market collapsed and the recession hit.

About this article: