Canada bubble fears stoked by launch of short-focused Spartan fund

By Camilla Hall

Investors in Canada are to get the chance to bet against their own real estate market as one of the first short-focused funds is set to launch in the country, where concerns have grown that there is a housing bubble ready to burst.

The Spartan/Libertas Real Asset Opportunities Fund, set to launch in Toronto in the first quarter of next year, will allow Canadian brokers, developers or pension funds to mitigate their exposure towards a possible downturn in the real estate market, Michael Brown, manager of the fund told the Financial Times.

The new fund reflects broader investor interest in shorting or hedging risk to Canada after high-profile names from Steve Eisman, featured in Michael Lewis’sThe Big Short, to Robert Shiller, the Nobel-prize winning economist, have raised questions over the challenges facing the Canadian real estate market.

“The thesis behind the fund is that the Canadian housing market is one of the most overvalued in the world,” said Mr Brown. “A lot of things people observed in the US in the run-up to 2007-8 crisis are happening here.”

The OECD has ranked Canada as one of the countries most at risk of a price correction, especially if borrowing costs increase or income growth slows. Deutsche Bank recently said Canada is the most overvalued market in the world, with a 60 per cent overvaluation, above Belgium and Norway.

Canada’s average home price index has increased 20.2 per cent in the past 36 months, according to the Canadian Real Estate Association. Average existing home prices in Canada were at C$391,997 in November, 50 per cent higher than in the US, according to analysis by BMO Capital Markets.

Canada bears point to how low interest rates and the government’s backing of the mortgage market – by insuring home loans – have fuelled a real estate bubble and worse, stoked a consumer borrowing binge.

The ratio of household debt to disposable income has grown to 152 per cent in Canada, near to the US peak of 165 per cent, according to a December report from Canada’s central bank.

The level of the government’s involvement in the mortgage boom has drawn the attention of the International Monetary Fund, analysts and regulators as the portfolio of home loans insured by the Canada Mortgage and Housing Corporation has swelled to $560bn.

“When something gets that big, even governments get nervous,” Mr Eisman, founder of Emrys Partners told a conference in New York in May, attracting the attention of global investors.

But, since May, shares in mortgage company Home Capital Group – singled out by Mr Eisman – have increased more than 40 per cent and stocks of Genworth MI Canada have risen more than 30 per cent.

The new fund is being launched through Toronto-based Spartan, a multi-fund investment platform for individual hedge fund managers. Mr Brown was a managing director and partner of Enterprise Capital Management, a small, privately owned hedge fund sponsor.

While Mr Brown would not give specifics of the trades, the fund could look at strategies such as shorting equities or buying put options to bet on asset price declines, an alternative method of hedging.

It will bet on price declines across asset classes from equities, to fixed income and target sectors such as financial companies and real estate-linked companies, as well as the currency, said Mr Brown.

Goldman Sachs has recommended shorting the loonie, as the Canadian currency is known, as one of its top 2014 trades. In a separate report, Goldman also warned of the risks of overbuilding in Canada and said price declines could be “quite significant” in the event of a housing bust.

However, Canadian companies and banks are quite resolute in their rejection of the hedge fund bears and in particular, the comparisons they make with the US subprime mortgage crisis.

“[Canadian] Banks don’t lend money to people who can’t afford to buy houses and can’t afford to service the mortgages,” Gordon Nixon, chief executive of the Royal Bank of Canada told the Financial Times.

More @ http://www.ft.com/

Meanwhile, buy … Here is a Modern Weirdo. Weird it may be, we’re still talking about close to $1 million bucks.

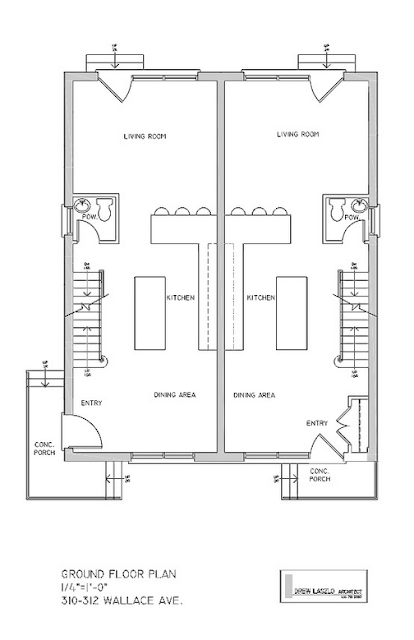

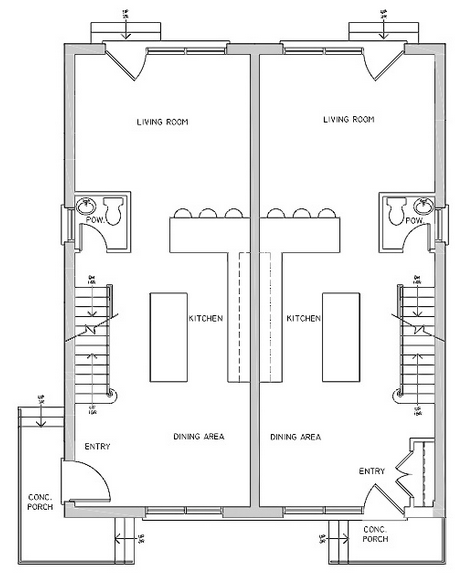

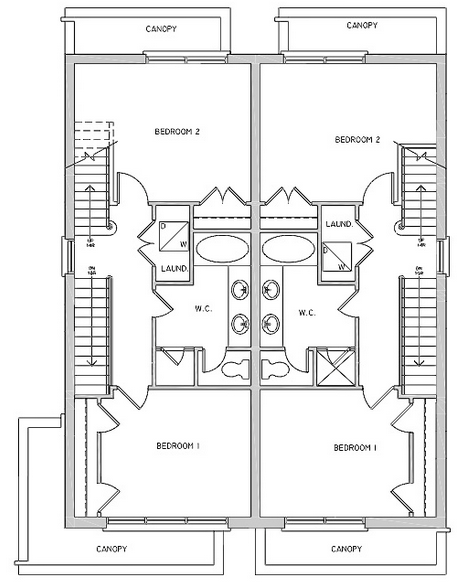

310 Wallace Avenue – JUNCTION TRIANGLE