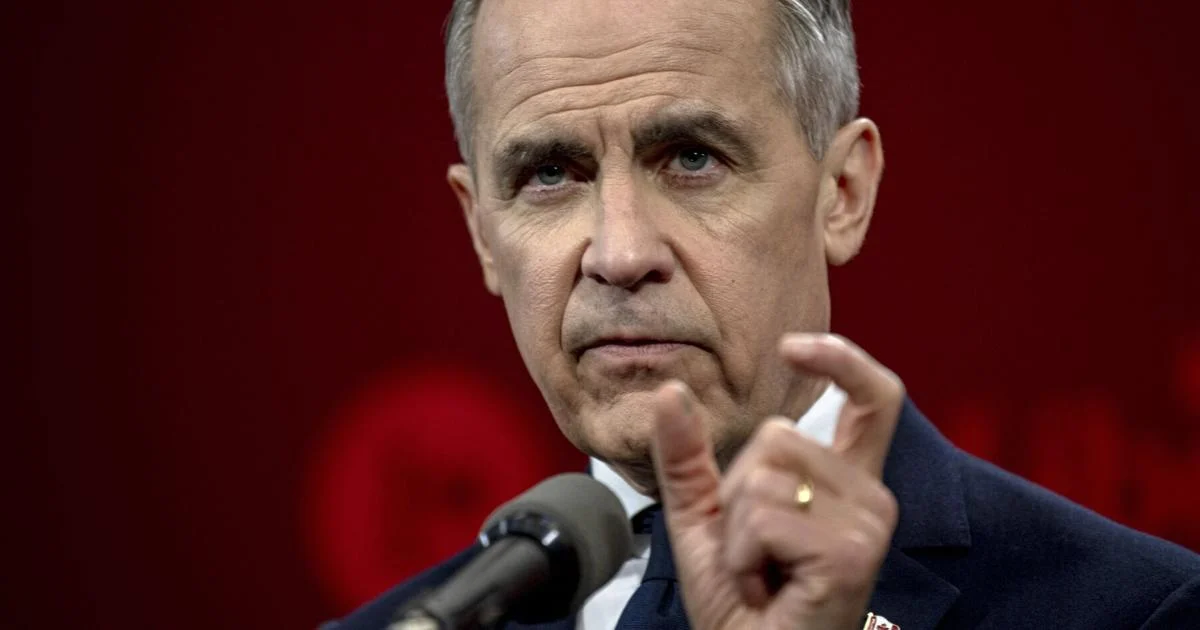

Mark Carney, the former Governor of the Bank of England and the Bank of Canada, has had a distinguished career in central banking and finance. However, his tenure has not been without controversy. Below is a list of notable negative stories and scandals involving him:

1. Brexit Warnings Criticized (2016)

- Carney was accused of being overly pessimistic about the economic risks of Brexit, with critics (including some pro-Brexit politicians) claiming he exaggerated the potential damage to the UK economy.

- Former UKIP leader Nigel Farage and others accused him of political bias and “talking down” the economy.

- More: Mark Carney’s Scandals: Biased Brexit Fearmongering by Failed Second-Tier Canadian Politician (2016)… “The Boy Who Cried Wolf peddling phony elite conspiracy, overstepped his role and meddling with British politics

2. Bank of England’s Brexit Forecasts (2016-2017)

- The Bank of England’s post-Brexit recession warnings did not materialize as predicted, leading to criticism that Carney and the BoE had spread unnecessary fear.

- Some economists and politicians argued that the BoE’s models were flawed, damaging Carney’s credibility.

3. “Negative Interest Rates” Controversy (2020)

- Carney floated the idea of negative interest rates during the COVID-19 pandemic, which sparked backlash from savers and some economists who argued it would hurt pension funds and bank profitability.

- Critics accused him of favoring financial markets over ordinary savers.

- More: Mark Carney’s Scandals: Negative Interest Rates Controversy (2020)… “Voodoo Economist proposed to Steal Savings, punish Prudent Britons, damaged public trust in central bank policies”

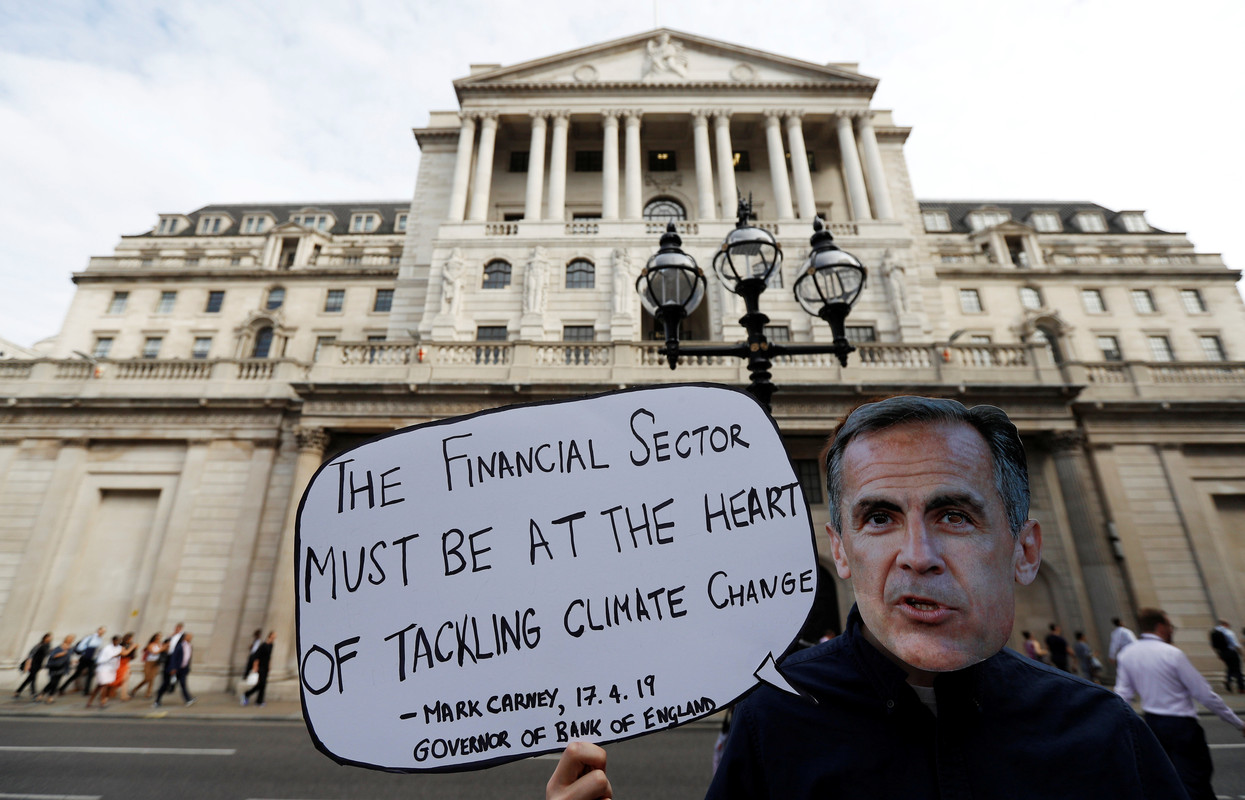

4. Climate Activism and Political Overreach (2019-2020)

- As a strong advocate for climate-related financial reforms, Carney faced criticism for overstepping the traditional role of a central banker by pushing green policies.

- Some lawmakers and commentators argued that his focus on climate change was outside the BoE’s mandate of price stability.

- More: Mark Carney’s Scandals: Climate Activism and Political Overreach (2019-2020)… “Unelected Woke Banker dictating energy policy aka Green Jihad by another Woke Central Banking Elite disconnected from cost-of-living”

5. Silentus Scandal (2022-2023) – Greensill Capital Links

- After leaving the BoE, Carney joined the board of Silentus, a firm linked to Greensill Capital, which collapsed in 2021 amid allegations of risky lending practices.

- His association with Silentus raised questions about potential conflicts of interest, given his previous regulatory role.

6. UN Climate Role and Private Sector Ties (2020-Present)

- As UN Special Envoy on Climate Action and Finance, Carney has been scrutinized for his ties to major financial institutions, including Brookfield Asset Management (which has investments in fossil fuels).

- Critics argue that his private sector roles undermine his credibility as a climate advocate.

- More: Mark Carney’s Scandals: UN Climate Role and Private Sector Ties (2020-Present)… “Davos Elite Scammer lying through his teeth on Net-Zero Greenwashing and collecting Double-Dipping Compensation without Zero Accountability”

7. Bank of Canada Tenure – Housing Market Risks (2010-2013)

- Some economists later argued that Carney’s low-interest-rate policies at the Bank of Canada contributed to Canada’s housing bubble and rising household debt.

- While praised during his tenure, his policies were later seen as a factor in long-term financial instability.

- More: “Father of Housing Crisis –kickstarted Housing Affordability Crisis, fueling rampant real estate speculation, irresponsible QE, and failed to mitigate the problem”

- Even More: Mark Carney kickstarted Housing Affordability Crisis by slashing Interest Rate to the Lowest possible at 0.25%, fueling rampant real estate speculation along with irresponsible QE and failure to implement alternative Policies to mitigate the problem

8. “Global Citizen” Tax Controversy (2021)

- Carney, a dual UK-Canadian citizen, faced criticism for his tax arrangements, with reports suggesting he structured his finances to minimize tax liabilities while advocating for higher corporate taxes as a climate envoy.

- More: Mark Carney’s Scandals: Global Citizen Tax Evasion (2021)… “Elite Tax Evasion by creepy Oligarch abusing the ‘Non-Dom’ tax status — Monkey See, Monkey Do”

While Carney remains a respected figure in global finance, these controversies have occasionally drawn criticism from politicians, economists, and the media. His post-central banking roles in climate finance and private business have kept him in the spotlight, sometimes attracting scrutiny over potential conflicts of interest.

That said,

Why Do We Want An Incompetent Privileged Oligarch To Be The Prime Minister?

Why would one thinks a proven hypocrite with scandalous track records like Mark Carney will have folks interest at heart?

Never mind the potential plundering of national coffer and other conflicts of interest (but buried) all over the internet archives, which Carney has demonstrated he has no qualm committing such repugnant acts that’s beyond scandalous eg. unethically collecting Double-Dipping Compensation with Zero Accountability… Another equally important question to ask is how can a central bank governor who has exhibited utter Incompetence, Ignorance, Naivety, even on subject matters such as economy and fiscal policy which is supposedly his specialty expertise? (Britons call him ‘Ivory Tower Economist’ or even weirdo like ‘Voodoo Bankster’ ).

Why did folks call Carney such despicable names like “out-of-touch hypocrite”, “profiteering Davos man”, “private jet-setting banker pretending to save the planet” for messing around with Elite Net-Zero Greenwashing that’s is full of lies, scams, hypocrisy, or according to the climate activists, downright criminal?

What could the reason for electing such an privileged Oligarch to pull string on our national purse?

Here’s a breakdown of Mark Carney’s major scandals, including his role at Brookfield Asset Management, his position as UN Climate Envoy, and criticisms during COP26.

1. Brookfield Asset Management & “Carbon Neutral” Greenwashing (2020–Present)

The Core Controversy

After leaving the Bank of England, Carney joined Brookfield Asset Management (2020) as Vice Chair and Head of Transition Investing. Critics accused him of hypocrisy because:

- Brookfield’s Fossil Fuel Holdings: The firm owned oil pipelines, coal plants, and other fossil fuel assets, including:

- TC Energy (formerly TransCanada): Stake in the Keystone XL pipeline (later canceled but still controversial).

- TerraForm Power: Owned coal plants in the U.S.

- Alberta Oil Sands Investments: Indirect exposure via private equity.

- “Carbon Neutral” Claims: Brookfield claimed its $575B portfolio was “carbon neutral”, but this relied on:

- Renewable energy offsets (e.g., wind/solar investments balancing out emissions).

- Excluding “third-party emissions” (e.g., not counting pollution from pipelines it operated but didn’t fully own).

Public & Activist Backlash

- Greenpeace & Extinction Rebellion: Accused Carney of “climate-washing”—helping a major investor appear green while profiting from fossil fuels.

- Media Criticism:

- The Guardian (2021): “Mark Carney’s Brookfield role undermines his climate leadership.”

- Bloomberg: Highlighted how Brookfield’s carbon math was “misleading” because it excluded Scope 3 emissions (burning the oil/gas it transported).

- UN Conflict of Interest Concerns: As UN Special Envoy, Carney was supposed to push for fossil fuel divestment, yet his employer was expanding in the sector.

Outcome: The controversy reinforced skepticism about Wall Street’s role in climate policy—can financiers really lead the green transition, or are they just rebranding business as usual?

2. COP26 (2021) – “Glasgow Financial Alliance for Net Zero” (GFANZ) Criticism

The Controversy

At COP26, Carney (as UN Climate Envoy) launched GFANZ, a coalition of banks and investors pledging $130 trillion for net-zero goals. But critics called it “empty promises” because:

- No Binding Commitments: Banks could still fund fossil fuels (e.g., JPMorgan, Citi remained top oil/gas lenders).

- Loopholes Allowed: GFANZ members could offset emissions rather than cut them.

- Carney’s Dual Role: As a Brookfield exec, he was seen as protecting financial interests while posing as a climate champion.

Backlash

- Greta Thunberg dismissed GFANZ as “blah blah blah”, echoing her broader COP26 critique.

- Oxfam & Reclaim Finance: Warned GFANZ was a “greenwashing exercise” without strict rules.

- Developing Nations: Argued GFANZ favored rich-world investors over climate justice.

Aftermath

By 2023, GFANZ weakened its rules after Wall Street banks threatened to quit over strict fossil fuel limits—confirming activists’ fears that finance controls climate policy, not the other way around.

3. UK Austerity & Bank of England Legacy (2013–2020)

Before his climate role, Carney faced criticism as BoE Governor:

- “Working-Class Austerity vs. Elite Bailouts”: While he backed quantitative easing (QE) (helping banks & asset prices), UK austerity policies hurt public services.

- Brexit Warnings: His 2016 doom-laden Brexit predictions (e.g., recession risk) were seen as “Project Fear”—some materialized, but not as severely as forecast.

- Banker Bonuses: Defended high finance pay, clashing with Labour’s John McDonnell, who called him out for “elitist economics.”

4. Revolving Door: From Central Banking to Wall Street (2020–Present)

Carney’s post-BoE career raised “revolving door” concerns:

- Brookfield (2020): Joined a firm with major fossil fuel stakes.

- Stripe (Board Member): While advocating carbon removal, Stripe’s tech clients include oil companies.

- KKR & Other Funds: Advised private equity giants criticized for asset stripping (notoriously anti-worker).

Critics’ Take: His career symbolizes how elites profit from both crisis (2008 bailouts) and climate policy (green finance deals).

Conclusion: The Carney Paradox

Mark Carney is a key architect of “climate capitalism” — the idea that finance can save the planet. But his controversies reveal:

❌ Credibility Gap: Private sector ties (Brookfield, tax status) clash with his moral rhetoric.

🔥 Legacy: Will he be remembered as a reformer or a greenwasher? Depends on whether Wall Street actually defunds fossil fuels—or just rebrands them.

Related Scandals:-

- Mark Carney’s Scandals: Bank of Canada Tenure – Housing Market Risks (2010-2013)… “Father of Housing Crisis –kickstarted Housing Affordability Crisis, fueling rampant real estate speculation, irresponsible QE, and failed to mitigate the problem”

- Mark Carney’s Scandals: The Silentus Scandal (2022-2023)… “Elite Privilege & Revolving Door Hypocrisy cashing in regulatory connections raised ethical concerns”

- Mark Carney’s Scandals: Climate Activism and Political Overreach (2019-2020)… “Unelected Woke Banker dictating energy policy aka Green Jihad by another Woke Central Banking Elite disconnected from cost-of-living”

- Mark Carney’s Scandals: Bank of England’s Brexit Doom Forecasts WRONG (2016-2017)…”Carney the Catastrophist scaremongering with broken crystal ball, resulting in Public Distrust in institution with Zero Credibility left”

- Mark Carney’s Scandals: UN Climate Role and Private Sector Ties (2020-Present)… “Davos Elite Scammer lying through his teeth on Net-Zero Greenwashing and collecting Double-Dipping Compensation without Zero Accountability”

- Mark Carney’s Scandals: Global Citizen Tax Evasion (2021)… “Elite Tax Evasion by creepy Oligarch abusing the ‘Non-Dom’ tax status — Monkey See, Monkey Do”

- Mark Carney’s Scandals: Negative Interest Rates Controversy (2020)… “Voodoo Economist proposed to Steal Savings, punish Prudent Britons, damaged public trust in central bank policies”

- Mark Carney’s Scandals: Biased Brexit Fearmongering by Failed Second-Tier Canadian Politician (2016)… “The Boy Who Cried Wolf peddling phony elite conspiracy, overstepped his role and meddling with British politics

Bonus:-

He proposed we may resolve the cirisis with “Kiddie Voodoo House Designs”:-

Mark Carney’s Scandals: Bank of Canada Tenure – Housing Market Risks (2010-2013)… “Father of Housing Crisis –kickstarted Housing Affordability Crisis, fueling rampant real estate speculation, irresponsible QE, and failed to mitigate the problem”

Mark Carney’s Scandals: Bank of Canada Tenure – Housing Market Risks (2010-2013)… “Father of Housing Crisis –kickstarted Housing Affordability Crisis, fueling rampant real estate speculation, irresponsible QE, and failed to mitigate the problem”

Whaddaya Say?