Canada’s Widespread Homelessness Due To Housing Crisis

Mark Carney served as the Governor of the Bank of Canada (BoC) from 2008 to 2013, a period that included the aftermath of the global financial crisis (GFC) and a rapidly heating Canadian housing market. Carney’s tenure has faced criticism—particularly regarding his handling of housing market risks and low interest rates that may have contributed to Canada’s housing affordability crisis.

Mark Carney: ‘Father of Housing Crisis’

Carney slashed the overnight rate from 2.25% (Oct. 2008) to 0.25% (Apr. 2009) in less than a year. The rate cuts kickstarted the housing debt boom that fuel rampant real estate speculation which turned into today’s housing affordability crisis.

As if not bad enough, he also implemented Quantitative Easing (QE) irresponsibly and failure to implement alternative Policies to mitigate the problem. Unlike the U.S., Canadian banks also didn’t stop mortgage lending and this helped house prices rebound too quickly leading to disastrous consequences.

Carney lit the match, and others poured gasoline

When Carney left for the Bank of England in 2013, the rates were still just 1.00%. And his successors (Poloz, Macklem) kept rates low for even longer just to exacerbate the crisis.

Final Verdict: Carney’s Rate Cuts Started the Problem, But Others Made It Even Worse

Analogy: Carney gave Canada painkillers for a broken leg (2008 crisis). Later leaders never fixed the leg, just kept upping the dose (low rates + debt)…

Key Controversies & Criticisms During Carney’s Tenure (2010-2013)

1. Keeping Interest Rates Too Low for Too Long

- After the 2008 financial crisis, the BoC under Carney slashed its overnight lending rate to a historic low of 0.25% in 2009 and kept it at 1.0% until 2010, then slowly raised it to 1.25% by late 2010 before pausing due to global economic uncertainty.

- Critics argue that ultra-low borrowing costs fueled excessive mortgage lending, driving up home prices, particularly in Toronto and Vancouver.

- The cheap credit environment led to a surge in household debt, with Canada’s debt-to-income ratio rising sharply.

2. Failure to Tighten Mortgage Rules Sooner

- While Carney did introduce some mortgage rule tightening (e.g., reducing maximum amortization periods from 40 to 30 years in 2011 and then 25 years in 2012), critics say these measures were too little, too late.

- The housing bubble continued to inflate, with prices rising by over 50% in some markets between 2009 and 2013.

- Some economists argue that Carney should have imposed stricter mortgage qualification rules earlier or worked more aggressively with regulators (OSFI, CMHC) to curb speculative buying.

3. Public Downplaying of Housing Risks

- In 2011-2012, Carney repeatedly stated that Canada’s housing market was not in a bubble but instead experiencing a “slowdown” or “soft landing.”

- However, by 2013, even the IMF and OECD warned that Canada’s housing market was overvalued by 10-30%.

- After Carney left for the Bank of England in mid-2013, his successor, Stephen Poloz, faced a much more inflated market, leading to further regulatory tightening.

4. Legacy: Did Carney Inadvertently Fuel the Housing Crisis?

- Critics, including former Parliamentary Budget Officer Kevin Page, suggest that prolonged low rates and lax mortgage rules under Carney set the stage for Canada’s current affordability crisis.

- By the time Carney left in 2013, household debt had reached 165% of disposable income, a record high.

Aftermath & Long-Term Impact

- Carney’s successor, Stephen Poloz, had to introduce tougher stress tests in 2016-2017 to cool the market.

- Today, Canada’s housing affordability is among the worst in the developed world, with prices nearly doubling nationally since 2013.

- Some economists argue that if the BoC had raised rates sooner or tightened mortgage rules earlier, the bubble might not have grown as severely.

More details of the scandal here:-

Mark Carney kickstarted Housing Affordability Crisis by slashing Interest Rate to the Lowest possible at 0.25%, fueling rampant real estate speculation along with irresponsible QE and failure to implement alternative Policies to mitigate the problem

And what’s Carney’s solution to the very crisis he kickstarted?

He proposed we may resolve the cirisis with “Kiddie Voodoo House Designs”:-

Mark Carney wants us to believe Housing Crisis can be resolved with some ridiculous ‘Kiddie Voodoo House Designs’… See the debut of his “Building Canada Strong” House Designs for yourself

Mark Carney wants us to believe Housing Crisis can be resolved with some ridiculous ‘Kiddie Voodoo House Designs’… See the debut of his “Building Canada Strong” House Designs for yourself

Judging from this ‘brilliant idea’, Mark Carney either has No Idea What’s Causing the Housing Crisis, or he’s just another Political Low Life aka ‘Licensed Scammer’…

“This alone suggests your vote for Mark Carney is in all likelihood… a Lost Cause.

Yes, the Father of Canadian Housing Mark Carney wants us to believe some sh*tty house designs alone can resolve the HOUSING CRISIS created by none other the Bank of Canada’s Governor a decade ago (Mark Carney) !

Is this a LOL comedy or Mark Carney seriously think Canadians are just that… Low IQ Hillbilly Lumberjack?”

Fact: Housing crisis absolutely has nothing to do with house design and no design can ever resolve the housing crisis — simply because the root of crisis due to the literal ZERO 0% Interest Rate introduced by none other Mark Carney our Housing Crisis Genius… sigh.

Canada’s Homelessness

Related Scandals:-

- Mark Carney’s Scandals: The Silentus Scandal (2022-2023)… “Elite Privilege & Revolving Door Hypocrisy cashing in regulatory connections raised ethical concerns”

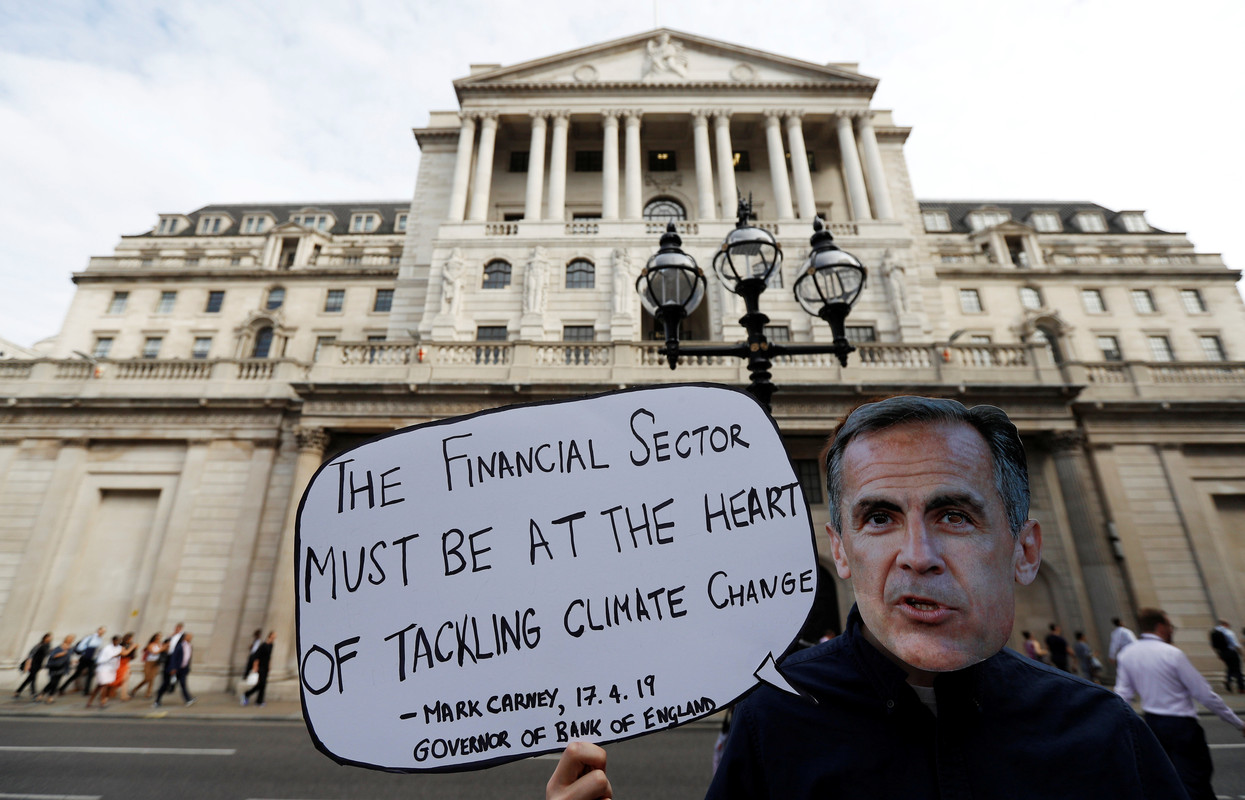

- Mark Carney’s Scandals: Climate Activism and Political Overreach (2019-2020)… “Unelected Woke Banker dictating energy policy aka Green Jihad by another Woke Central Banking Elite disconnected from cost-of-living”

- Mark Carney’s Scandals: Bank of England’s Brexit Doom Forecasts WRONG (2016-2017)…”Carney the Catastrophist scaremongering with broken crystal ball, resulting in Public Distrust in institution with Zero Credibility left”

- Mark Carney’s Scandals: UN Climate Role and Private Sector Ties (2020-Present)… “Davos Elite Scammer lying through his teeth on Net-Zero Greenwashing and collecting Double-Dipping Compensation without Zero Accountability”

- Mark Carney’s Scandals: Global Citizen Tax Evasion (2021)… “Elite Tax Evasion by creepy Oligarch abusing the ‘Non-Dom’ tax status — Monkey See, Monkey Do”

- Mark Carney’s Scandals: Negative Interest Rates Controversy (2020)… “Voodoo Economist proposed to Steal Savings, punish Prudent Britons, damaged public trust in central bank policies”

- Mark Carney’s Scandals: Biased Brexit Fearmongering by Failed Second-Tier Canadian Politician (2016)… “The Boy Who Cried Wolf peddling phony elite conspiracy, overstepped his role and meddling with British politics

Mark Carney’s Scandals: The Silentus Scandal (2022-2023)… “Elite Privilege & Revolving Door Hypocrisy cashing in regulatory connections raised ethical concerns”

Mark Carney’s Scandals: The Silentus Scandal (2022-2023)… “Elite Privilege & Revolving Door Hypocrisy cashing in regulatory connections raised ethical concerns”

Whaddaya Say?