In 1980, a full year of arts and science cost $655.00

In 1990, a full year of arts and science cost $1344.00

In 2010, a full year of arts and science cost $4900.00

That is an increase of almost 650%. To put that into perspective, housing inflation since 1980 has increased by 350%, while inflation has increased just over 150%.

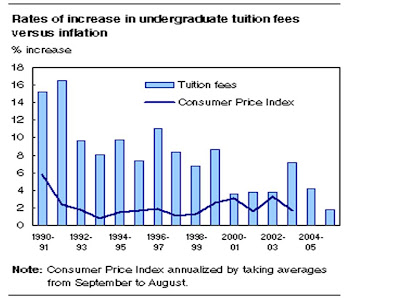

This chart shows tuition fees across Canada versus inflation between 1990 and 2005.

Higher Education’s Bubble Ready To Burst (from the US)

It’s a story of an industry that may sound familiar.

The buyers think what they’re buying will appreciate in value, making them rich in the future. The product grows more and more elaborate, and more and more expensive, but the expense is offset by cheap credit provided by sellers eager to encourage buyers to buy.Buyers see that everyone else is taking on mounds of debt, and so are more comfortable when they do so themselves; besides, for a generation, the value of what they’re buying has gone up steadily. What could go wrong? Everything continues smoothly until, at some point, it doesn’t.Yes, this sounds like the housing bubble, but I’m afraid it’s also sounding a lot like a still-inflating higher education bubble.

Consumers would balk, except for two things.

First — as with the housing bubble — cheap and readily available credit has let people borrow to finance education. They’re willing to do so because of (1) consumer ignorance, as students (and, often, their parents) don’t fully grasp just how harsh the impact of student loan payments will be after graduation; and (2) a belief that, whatever the cost, a college education is a necessary ticket to future prosperity.

According to Statistics Canada’s Youth in Transition Survey, 70 per cent of high school graduates who do not go on to post-secondary education cite financial reasons as the main factor…Monies owed to the federal government alone for student loans will surpass $15 billion this fall.

The average University graduate is leaving school with a debt load past $30,000. But it is not uncommon for a couple of recent grads to have a debt load of over $75,000. And they are getting peanuts out of University? And that is if they get a job in the field they went to school for!

What does this have to do with the housing bubble?

With house prices and debt loads so high, many recent grads will have to delay the purchase of a home and/or the starting of a family will be delayed by a few years. And the only reason why first time buyers are willing to pile on the debt to buy a home is that they believe that real estate is a firm and safe investment. We have to remember that first time buyers are the foundation of the housing market. If consumer sentiment about real estate changes, then the first time buyer is not there any more. Take away first time buyers and the market collapses.

I firmly believe that the housing market/bubble will pop. Many economic housing indicators show we are in a housing bubble. The questions I have, are a) How far will it drop? b) How long will it take to hit bottom? History tells us that the average housing bust shaves 34% off of prices and lasts 6 years.

Does Saskatoon and/or Canada have an average housing bubble?

We know that as boomers get older, they will negatively affect real estate. But to think that the generation of future buyers who are currently working at DQ and will most probably be saddled with massive debts out of University will save the housing bubble from popping is a stretch. Why would they stretch their pay cheque to be a depreciating asset? They will want to enjoy life and will not want to be house poor like many of Saskatoon’s recent first time buyers. The recent article in the University paper ” City housing cost’s too high.” makes me believe the new generation of buyers will be smarter than the last one.