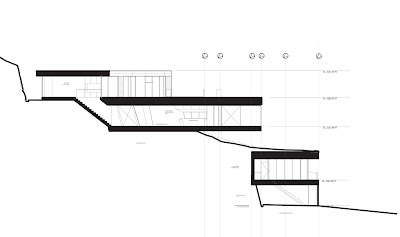

Modern slope house design, Canada

Five levels modern slope house design (Canada) is distributed along a steep mountain slope, developing diverse relations to the surrounding views, the landscape and the internal program or functions of the house.

Architecture and photography: Studio NminusOne

By Peter Boehm

We’ve tallied the benefits, now it’s time to flip the coin and look at the problems it can cause.

In my last column we looked at the positive side of house price growth being that it: creates a feeling of wellbeing; generates increased consumer confidence; supports associated industries, helps provide retirement capital; and helps strengthen the banking system. Now let’s flip the coin and look at the problems house price rises can cause.

1. Locks people out of the market

One of the biggest problems with rising property prices is that it becomes unaffordable to many first time buyers thereby either keeping them out of the market or requiring them to take on more risk if they want to be homeowners. Those already in the market may be priced out of upgrading or relocating, meaning they could be stuck where they are or have to downgrade if they need to move.

2. Not everyone benefits

Rising prices really only benefit those who already own property. Everyone else has to pay more and this adversely affects the next generation of perspective home owners. But it also affects renters as landlords increase rent in order to reflect higher asset costs and the desire to maintain rental yields. This could lock renters out of the market as well as buyers.

3. Increases household debt

Rising prices means new buyers have to take on more debt. This places many under financial stress (because more of their disposable income goes towards debt repayment) and exposes them to future interest rate increases. It also puts a further strain on savings levels as more cash is needed to go towards saving a deposit and ongoing mortgage repayments. This could result in a significant increase in highly geared households with little or no cash reserves. Clearly this is not a desirable outcome, especially if prices start to fall.

4. Leads to increased investment in a non-productive asset

Putting aside the point that we all need somewhere to live, residential property is seen as a passive asset that does little to improve economic activity or Australia’s competitiveness in the global marketplace. Of course, new housing construction and renovations and the purchase of consumer and household goods does add value to the economy but in the context of the billions of dollars we have tied up residential property, is there too much focus on this one asset class and not enough spent elsewhere?

The argument goes that if we invested what we spent on property price increases over the past decade or so in productivity gains and new and emerging industry sectors Australia would have a much more competitive and stronger economy.

5. Prices can go down too

What goes up also comes down and property prices are no different. The property market is susceptible to booms and busts driven by many domestic and global factors. While the long term trend is still positive, price reductions or major corrections can and do happen during a cycle and can have devastating effects on households, lenders and the broader community. So the greater the price increase, the greater the potential fall and the deeper the problems that may ensue.

So now back to the original question. Is house price growth good for Australia? I would say the answer is a qualified “yes”. There’s a need to balance providing as many people as possible with access to affordable and quality housing, with the fact that property (or more correctly the land it is on) is a long term asset that provides not only shelter but a return on investment and a form of retirement savings. So price growth to my mind would need to at least keep up with inflation and reflect the investment in and improvements made to the property.

The problem arises of course when demand outstrips supply and market forces push prices well above what the average person would expect to pay – or can afford.

Peter Boehm’s book The Great Australian Dream: A Guide to Buying Your First Home is available online and at all good bookstores. It’s an easy to read and comprehensive how-to guide that will help you successfully navigate the numerous challenges everyone faces when entering the property market as an owner occupier or investor. It is also available as an iBook