For the past three years the Canadian Finance Minister, Jim Flaherty, and the Governor of the Bank of Canada, Mark Carney, have preached caution to Canadian households on the risks of excessive debt accumulation. Neither have gone so far as to declare an asset valuation “bubble” within the Canadian real estate market. However, both Minister Flaherty and Governor Carney have both addressed the issue publicly on a relatively frequent basis. Included below is a small sampling of their publicly made warnings from December 2010 to June 2012. Included in these statements is a recent one from June 21st in which Governor Carney addressed excessive mortgage related lending as “the number one… domestic risk to the Canadian economy”:

“Our parents were more inclined to pay off that mortgage as soon as possible, and some Canadians are not as inclined to do that now…I encourage them to do it.””

– Jim Flaherty, Dec 13, 2010; Bloomberg

“… we want to caution Canadians [that] we will not facilitate excessive debt assumption by some Canadians at very low interest rates because that will lead to trouble in the medium and longer term.”

– Jim Flaherty, Jan 17, 2011; lfpress

“The risk is that expectations become extrapolative, prompting the classic market emotions of fear and greed – greed among speculators and investors, and fear among households that getting a foot on the property ladder is a now-or-never proposition,”

– Mark Carney, Jun 16, 2011; The Globe and Mail

“Canadians, particularly with respect to residential mortgages, should be mindful that interest rates are historically low right now. They’re not going to stay there forever,”

– Jim Flaherty, Nov 25, 2011; Reuters

“We have been cautioning Canadians for some time that they need to be prepared to have higher interest rates in the future and be aware of the affordability issue that may create.”

– Jim Flaherty, Jan 17, 2012; thestar.com

“These measures [tightening government-insured mortgage lending standards] reduce the number one risk, domestic risk to the Canadian economy,”

– Mark Carney, Jun 21, 2012; Reuters

Fortunately for indebted Canadian households, interest rates have yet to return to pre-recession levels as was hypothesized by many. In fact, the exact opposite has occurred with lending rates dropping as global economic events, dominated by the European Debt Crisis, unfold. These events have been partly responsible for the Bank of Canada’s (BOC’s) decision to pause on interest rate hikes. Adding to the BOC’s policy decision has been the effects on interest rates from investors shifting capital from equity markets and into bonds. Simply put, when it comes to borrowing, rates are low and therefore, “money is cheap“.

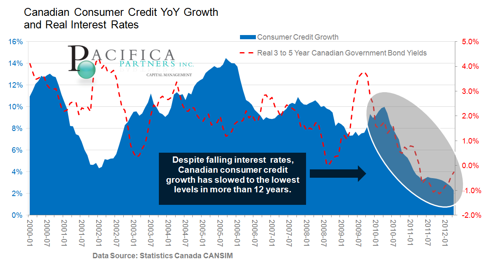

Household Debt stalling: A noteworthy observation is that despite falling bond yields and the resulting mortgage wars between Canadian lenders, debt accumulation by Canadian consumers has not grown significantly. Canadian household debt, both mortgage and personal debt, have stalled at the 90% of Gross Domestic Product (GDP) mark for a number of quarters. Furthermore, growth in Canadian personal debt (excluding mortgages) has also fallen, and is now growing at the lowest rate in more than a decade (see Chart below). If this trend continues, Canadian consumer credit may begin contracting. This contraction would be despite the fact that as mentioned earlier, borrowing rates have fallen.

Canadian Consumer Credit Growth

Canadian Consumer Credit GrowthThis observed slow-down of debt accumulation has occurred even before a significant change to mortgage lending rules took effect on July 9th, 2012. The rule change will likely act to further slow the accumulation of mortgage debt as well. As a result, we believe that the Canadian consumer has hit a point of “debt exhaustion” in which debt accumulation stalls not necessarily due to restrictive credit or higher borrowing costs, but due to the accumulation of multiple factors including economic fears, sentiment, stubbornly high unemployment, stagnant wage growth, as well as debt servicing limitations.

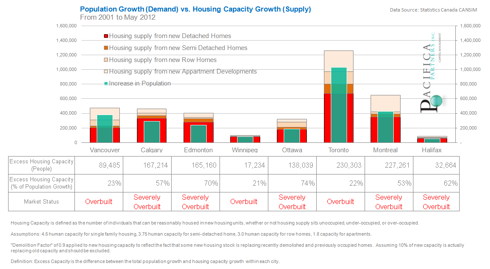

Why is debt so important to Canadian Real Estate? The decade long bull market in Canadian Real Estate has not been the result of “healthy drivers” such as income growth, growth of the economy, nor is it the result of housing scarcity. In fact, housing price growth has outpaced wage growth and GDP growth. In addition, most major Canadian cities are significantly over-supplied (see Chart below). Instead, housing price appreciation has been made possible in large part due to rampant debt accumulation, both mortgage and personal credit. Thus a lack of future debt accumulation by households implies that the key driver of past real estate performance may no longer be available to stimulate real estate going forward.

Canadian Population Growth vs. Housing Capacity Growth

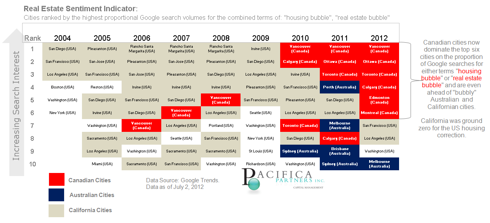

Canadian Population Growth vs. Housing Capacity GrowthShifting sentiment: As with all bull markets, changes in sentiment are a key indication of whether an inflection point has been reached. Our Real Estate Sentiment Indicator (see table below) shows that the six cities with the highest search volume proportions for the combined terms of “Housing Bubble” and “Real Estate Bubble” are now all Canadian. We interpret this as a noteworthy sentiment shift within these real estate markets. Effectively, the locals of each of the indicated cities are now searching for bearish real estate terms in proportionally more volume than other topics when compared to other cities around the world. The increase in use of these search terms indicates a potential change in consumer sentiment which may then extend to a pause in real estate’s upward price momentum.

(click to enlarge)

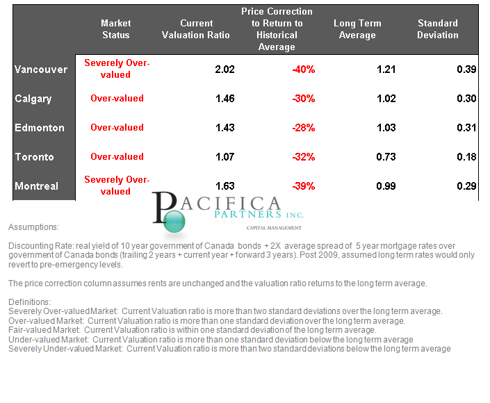

How overvalued are Canadian Real Estate markets? We have attempted to quantify the necessary price drops to bring specific real estate back to historical average multiples of discounted rental income. The findings in the table below indicate a required 30% to 40% correction in home prices in some major Canadian markets to achieve a return to long run averages.

Possible Price Corrections in Canadian Real Estate

Possible Price Corrections in Canadian Real EstateOur outlook on Canadian real-estate remains negative.

The above information is an excerpt of our Canadian Real Estate Chart Book July 2012 update. For the full report please click here

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information’s accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice. Past performance is not indicative of future performance. Please note that, as at the date of this report, our firm may hold positions in some of the companies mentioned. Social Media: It is Pacifica Partners Inc.’s policy not to respond via online and social media outlets to questions or comments directed to it or in response to its online and social media publications. Pacifica Partners does not acknowledge or encourage testimonials posted by third party individuals. Third party users that have bookmarked Pacifica Partners’ social media publications or profile through options including “like”, “follow”, or similar bookmarking variations are not and should not be viewed as endorsement of Pacifica Partners Inc., its services, or future or past investment performance. To view our full disclaimer please click here.

Whaddaya Say?